Executing the Strategy Consistently

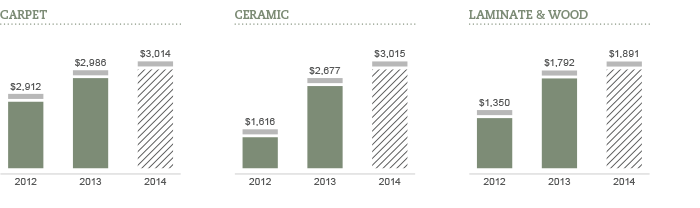

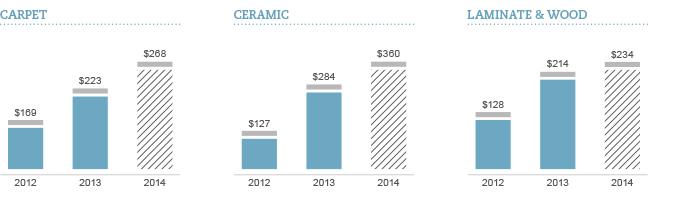

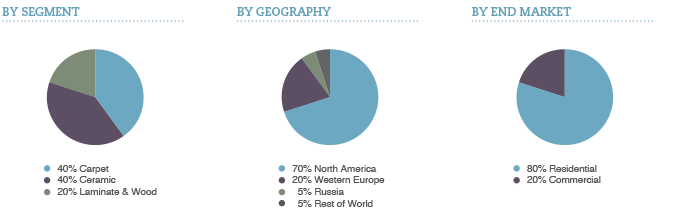

Over the past two decades, our successful transformation of Mohawk from a North American carpet manufacturer into the world’s largest flooring company has been defined by consistent strategy execution and continuous investment. Accordingly, we begin 2015 with approximately $450 million committed to investments focused on product innovation, capacity expansion and productivity enhancements within our existing businesses. In addition, we have announced our intention to acquire IVC Group, a leading sheet vinyl, luxury vinyl tile (LVT) and laminate flooring manufacturer that will enhance our leadership and international presence across

all major flooring categories. IVC meets our criteria for acquisitions that enhance our market position, extend our business into new product categories and provide the opportunity for significant returns.

As the fastest-growing LVT supplier in Europe, IVC’s manufacturing expertise will enhance our investment in

a recently completed LVT manufacturing facility in Belgium, as well as support our expansion of LVT sales in North America and elsewhere through a new manufacturing facility in the U.S. Last year, the LVT flooring category grew globally around 18 percent. Since its introduction in 2006, LVT has grown to represent about 5 percent of the total U.S. flooring market and is projected to increase more than 15 percent annually through the end of the decade. We will leverage our expertise in laminate production to benefit our LVT design and operations. The product’s realistic reproduction of the graining and character of hardwood or textured stone provides a value-priced flooring option that gained quick traction in commercial applications and has since been adopted by consumers.

In addition to the acquisition of IVC, we also announced our intent in early 2015 to purchase a small Eastern European ceramic manufacturer. The company has the low-cost position in the Bulgarian and Romanian markets and, once the acquisition is integrated into our global ceramic business, we will have opportunities to enhance the product offering, upgrade the manufacturing technology and expand exports to other markets.

Along with carpet, rugs, ceramic and laminate, we will add sheet vinyl and LVT to the product categories where Mohawk is positioned to enjoy leading positions in flooring markets that are among the largest in the world. Though our business grows increasingly diversified in both geography and product categories, our success remains rooted in common themes:

- Directing resources and placing the majority of operational responsibility within our business segments, rather than at the corporate level

- Strengthening management teams within our businesses in order to drive superior market knowledge and flawless strategy execution

- Focusing on continuous improvement in all aspects of the business as we look for ways to operate better, faster, smarter and at a lower cost

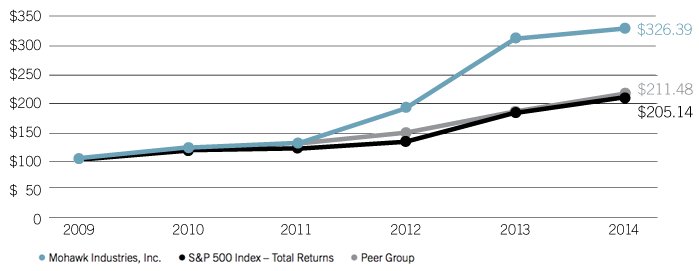

The success of this philosophy is reflected in our history

of generating shareholder return — a performance we are

committed to build upon as we maintain our repeated cycle of investment and growth on behalf of our shareholders. Thank you for your continued support.

Jeff Lorberbaum

Chairman and Chief Executive Officer