Download 2014 Annual Report PDF

W. Anthony Will

President and

Chief Executive Officer

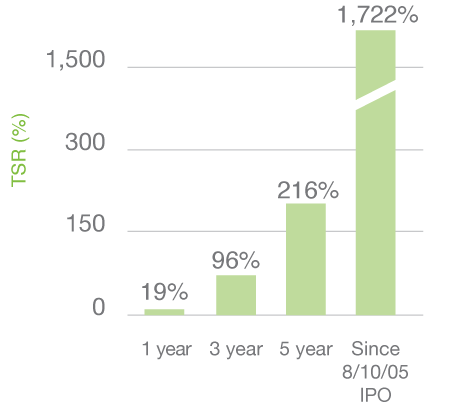

CF Industries has a compelling and advantaged business model that is relatively simple: there is a strong and growing demand for our products, and we are able to leverage a low-cost asset base to generate significant cash flow. Some of that cash is reinvested into high-return projects to grow our core business and the excess cash is returned to shareholders. This simple yet powerful business model has produced superior returns for our shareholders over any and all relevant measurement periods.

We are one of the world’s largest producers of nitrogen-based fertilizer, the only non-discretionary, non-substitutable crop nutrient, which farmers must apply every year or face an immediate reduction in yield. The nitrogen products we make are also used in a variety of industrial applications, including environmental applications to reduce or eliminate various emissions, and as an input for certain chemical processes. Nitrogen demand is projected to continue to grow at roughly two percent per year globally, or the equivalent of four to five new world-scale plants annually.

Given that nitrogen is a globally traded commodity, a low-cost production base is critical to long-term success. Natural gas is the primary raw material input in the manufacturing of nitrogen fertilizer, accounting for roughly 70 percent of the cash production costs. Importantly, over 90 percent of CF Industries’ production base is located in North America, a region with abundant and low-cost natural gas. As of the writing of this letter, North American full-year future gas costs on the NYMEX exchange remain under $4.00/MMBtu through 2022, significantly below the feedstock costs in other nitrogen production regions of the world.

This combination, a growing demand for our products coupled with a cost-advantaged asset base, is the cash-generation engine that is CF Industries today. We take our role as stewards of our shareholders’ capital very seriously. We employ a disciplined approach to investments in the business balanced with returning excess cash back to shareholders. Since the beginning of 2010, we have reinvested approximately $10 billion in the business through acquisitions and capital investments, including the full cost of the capacity expansion projects currently underway, while returning roughly $5.5 billion of cash to shareholders through share repurchases and dividends.

Approximately 40 percent of North America’s nitrogen requirements are currently met through foreign imports. Although there have been many new nitrogen production facility projects announced in recent years, few have progressed beyond an initial announcement. Even after all the new capacity currently under construction in North America comes online, imports will still be required to satisfy over 20 percent of North American demand. Given CF Industries’ extensive network of distribution assets in North America, including our deep water docks at Donaldsonville, Louisiana, which are well positioned to export products, we are ideally situated to serve local or international demand, as market conditions warrant.

We made significant progress on our major capacity expansion projects at Donaldsonville and Port Neal, Iowa. Upon completion, these projects will increase our production capacity by roughly 28 percent and are expected to generate internal rates of return in the mid-teens, well above our company’s cost of capital. The expansion projects have continued to progress according to schedule and are expected to begin coming online in the third quarter of 2015 and continuing into 2016.

We are proud of the critical role we play in the noble pursuit of helping to feed the world. The challenges associated with providing affordable food for all will significantly increase as the global population grows from seven billion people today to an expected nine billion by 2050. We are doing our part to help meet the increasing demand for more food by investing in new production capacity here in the United States while providing good, safe jobs to Americans.

In our efforts to be a good corporate citizen, we strive to "do more with less," and also provide products that help others reduce their environmental footprint: we are reducing our energy consumption and our emissions profile per unit of production, and our new production capacity will be among the most efficient plants in the world; we are making significant investments to enable us to produce diesel exhaust fluid, or DEF, that is used for emissions abatement in diesel trucks; and we produce other products that are used to reduce emissions in the power generation industry. We also support the 4R Nutrient Stewardship Program, which encourages farmers to utilize our products in an environmentally responsible manner. We are proud to be good stewards of the environment.

Finally, we provide our employees a safe work environment and well-paying jobs with full health coverage. In 2014, we achieved our best-ever safety performance, and an injury-severity rate that was roughly one-third of the industry average. With our new capacity expansion projects, we are adding over 200 full-time jobs with average pay of over $85,000 per year.

In 2014 we set new all-time company records, shipping 3.0 million tons of ammonia, and total nitrogen volumes of 13.3 million tons, up 2.6 percent over 2013. This allowed us to generate $2.7 billion in EBITDA, which included a $750 million pretax gain on the sale of our phosphate business, and net earnings attributable to common stockholders of $1.4 billion, or $27.08 per diluted share, which included a $463 million, or $9.01 per share, after-tax gain on the phosphate sale.

We made significant progress on the strategic front. We completed the sale of our phosphate business to The Mosaic Company for $1.4 billion in March of 2014, enabling us to redeploy that capital and sharpen our focus as a nitrogen pure play. We raised an additional $1.5 billion of long-dated, investment-grade debt with a low interest rate. These efforts, combined with cash from operations, enabled us to:

As we look forward to 2015 and beyond, we have great confidence in the sustainability of our cash flows: demand for our products is strong and continues to grow; we are readying to bring online new production that will increase our capacity by roughly 28 percent; North America will continue to require significant levels of imported product to meet demand; and ours is among the lowest-cost production bases in the world, underpinned by plentiful and low-cost North American natural gas.

I want to thank our customers for their business, our Board of Directors for their guidance and focus on exemplary governance practices, and our employees for their dedication, focus and continuing contributions. Our future is indeed bright, and together we will leverage our simple, yet powerful, business model to unlock the intrinsic value of our company and generate superior returns for our shareholders.